Before you read: This is a report I wrote over four months ago when the price was above $6 /share, please note some of the information may not be timely. This idea continues to interest me but due diligence should be performed before you consider investing. I’ve put some present thoughts at the end of the report.

Ticker: SRL | Price: $3.88 | Cap: $48.7.5m | Idea: Hidden/ Deep Value

Summary

Scully Royalty, previously MFC Bancorp, is a merchant bank with a seemingly black box of assets. Last year, April 30th, 2019, SRL reversed a $140 million impairment charge on their Scully Iron Ore mine located in Newfoundland, Canada. Since then the company has changed names[1] and began reorganizing their internal structure, separating into three subsidiaries: Scully Royalty, Industrial Equity, and Merkanti Holding. Scully Royalty subsidiary is the core value to SRL and is a royalty collecting business for a recently restarted Iron Ore mine. Industrial Equity is a merchant bank, mainly operating in China, with a focus in medical businesses. Merkanti Holding is a European merchant bank which owns a trade and structured finance bank named Merkanti Bank. We believe this reorganization coupled with the improved disclosure promised by management will unlocked the significant value gap SRL trades at. The improved disclosure is expected in the 20F due on April 30th, and we also expect a spin-off of previous mentioned businesses. This spin-off expectation comes from observing the record of the CEO which has built this business and his career off a myriad of spin-offs. At current prices, you are getting the mine royalty interest at a significantly reduced price and the remaining, black box of assets for free. As well, the company has no debt and $3.48 and share in net cash.

We expect a greater than 100% return on Scully Royalty and believe the mispricing is mainly a result of poorly disclosed assets, many of the assets being foreign based, their complex history, their microcap size, and a management used to not consult shareholders.

History

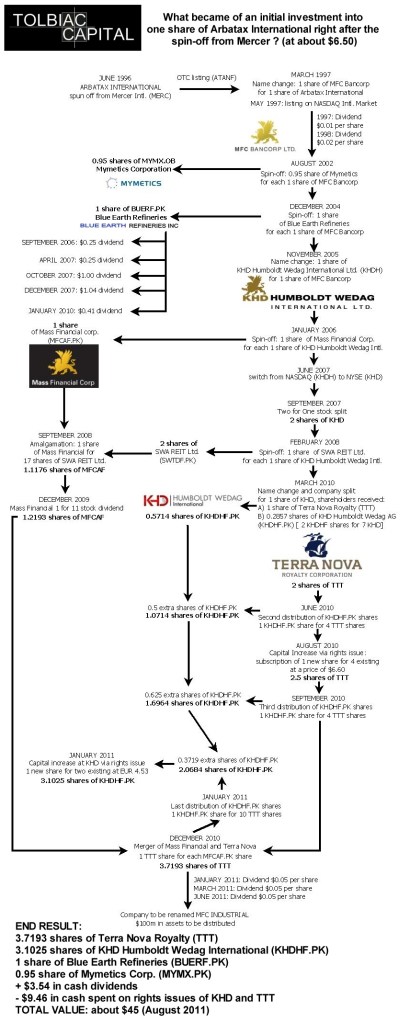

Scully Royalty was spun off as Arbatax International from Mercer International in 1996, quickly changing their name to MFC Bancorp in 1997. From 1997 to 2011, through a series of spin-offs and restructurings, Michael Smith, the CEO, did 15% annualized[2] in shareholder returns[3], compared to the S&P500 over the same period doing 4.4% annualized, not counting dividends. It is this history of spin-offs and restructuring that management once did so well that leads us to believe another one is around the corner.

From 2011 to today, SRL’s history has not been as glamorous. In 2013 Peter Kellogg, the largest shareholder now and in 2013, launched a proxy fight for Michael Smith’s termination. It ended with Kellogg securing two board seats. Shortly after this settlement, Smith stepped down and Gerardo Cortina assumed the President and CEO title. Over Cortina’s tenure, through a series of poor allocations and timed with the closure of Scully Mine whom they received royalty income from, SRL (MFC during this period) lost ~70% of their value. In 2017 Smith returned to the helm. While he had a successful track record prior to leaving, since his return the successes have not been of his own doing. Also, Smith changed SRL domicile to the Cayman Islands and headquarters to Hong Kong where shareholder rights are less established, causing disclosure to fall significantly. This is where I believe the book value to stock price separation began, especially as it had tracked quite well previously. A recent example was when they announced the $137 million reversal of impairment when they filed their 2019 annual report. An impairment reversal of this size on a market capitalization less than it should be material. A few years before that, they sold the majority of their hydrocarbon assets in Alberta and Saskatchewan without telling shareholders until many months after and just noting they were “rationalized”, never breaking down the sale prices. Even today, they have never disclosed clear information of their medical supply and service business in China or the name of their current hydrocarbon business, which is Notine.

Operations

Scully Mine Royalty – the main thesis

Scully Mine is located in Wabush, Newfoundland, Canada and is an old iron ore mine which was restarted this past June. SRL’s predecessors acquired the mining lease in 1956 which expires in 2055. It was previously operated under Cliff Natural. It is now under a new operator, Tacora Resources, with Scully Royalty having a royalty agreement on the mine. They earn 7% of net revenues at the port from iron ore shipped.

SRL must pay $0.1616 per dry metric ton of iron concentrate to Knoll lake, a subsidiary co-owned between Tacora and SRL, 58.2% and 40% respectively. Knoll lake pays a $360 royalty fee to the Canadian government per year. After any of Knoll Lake’s expenses are paid, the remaining funds are distributed back to SRL and Tacora.

Tacora Resources

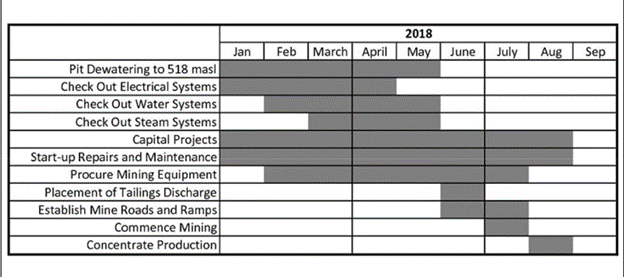

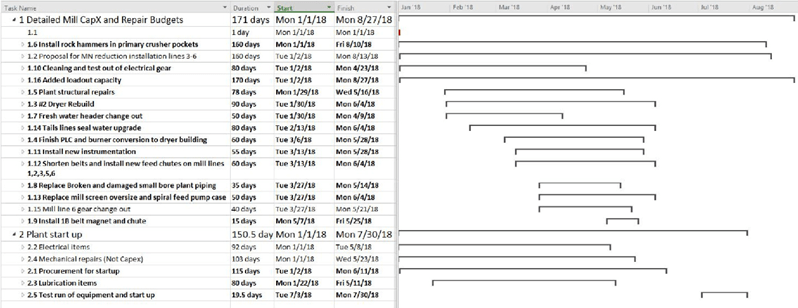

Understanding Tacora Resources, the mine operator of Scully mine, is essential to this report. In 2017 Tacora secured funding form Proterra Partners and Cargill and purchased the bankrupt operations from Wabush Resources, a subsidiary of Cliffs Natural. With a $274m USD equity raise and a 100% offtake agreement from Cargill until 2033, one of the larger iron ore traders in the world, Tacora was able to begin restoring operations. Originally planning to reopen by mid-2018. Though delays with environmental assessment approval (EAO) and scale of work required to refurbish existing dryers as well as much of the equipment requiring retooling delayed the plant start up. They only operated with a skeleton crew in 2018 did not announce mass hiring a crew until late November 2018. Tacora also sought to hire a relatively young workforce, not honoring union superiority to keep costs low. The negotiations with the union for this deal, as well as payments to the old pension plan helped cause initial delays

Original Operation Restart Timeline

Because of the delays, the first blast did not occur until June 2019. Since June, I have continued to monitor the mine ramp up phase, speaking with employees regarding any known issues along the way. The only notable one was a retooling phase, though not surprising when you are restarting machines which sat for four plus years. We would expect that the new timeline will have full production by 2022. See original ramp-up timeline below.

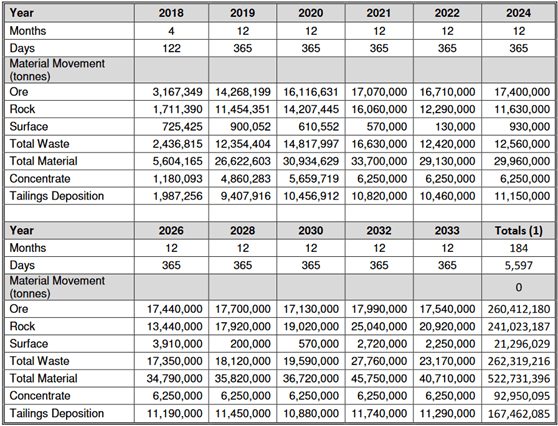

According to current shipment data available. Tacora had shipped 917,000 tonnes by year end 2019. All shipments are taken by rail to Port of Sept-Iles, Quebec and loaded there. The iron ore from Wabush mines is 65.9% iron, 2.58% Silica, and 0.2% Alumina making it exceptionally high quality, earning them a premium on iron ore prices. This premium is a result of the significantly reduced energy required to refine higher quality ore. The mine is expected to produce for 27 years with an extension of up to 50 years if Tacora decides to reprocess tailings. Scully would earn a 4.2% royalty on tailings production, though this form of ore production is expensive and inefficient. It is unlikely tailings processing occurs without any significant technology advancements.

In an effort to improve margins above that of the previous Cliffs Natural operations, they have replaced manganese reduction equipment. This was a problem during the past operations of the mine, reducing quality and in turn fines received. They also reduced the work force size from 500 (size during past operations) to 300 and hiring is done based on skill, not seniority (another issued the past mine faced). Along with other reductions, we now see a $44.31 cost per tonne giving the mine the ability to operate even under significant price drops. We should note that while the royalty is not based off mine profitability, it is important to the predictability of the royalty. All of this results in a lower risk mining operation and a consistent cash stream for SRL. The mine has been sending trains since late June (arriving 1st of July) and loading ships since August 26th. With 917,000 dry metric tonnes (dmt) shipped by year end 2019, which the market seems to have not priced in. Though for 2019 the royalty payment is credited against accumulated minimum payments made in the earlier years of restarting the mine[6]. Though going forward the payments will not be credited against past minimum payments. Below is a valuation for the royalty using expected production numbers.

Royalty Valuation

| Bear | Base | Bull | |

| Iron Ore Price | $ 90.00 | $ 100.00 | $ 110.00 |

| Quantity | 4,860,283 | 4,860,283 | 4,860,283 |

| Revenue | $ 437,425,470 | $ 486,028,300 | $ 534,631,130 |

| COGS | $ 103,426,822 | $ 103,426,822 | $ 103,426,822 |

| Net Revenue | $ 333,998,648 | $ 382,601,478 | $ 431,204,308 |

| Royalty | $ 23,379,905 | $ 26,782,103 | $ 30,184,302 |

| less: tax | $ 399,273 | $ 399,273 | $ 399,273 |

| Net Royalty | $ 22,980,632 | $ 26,382,830 | $ 29,785,029 |

| Multiple | 8 | 9 | 10 |

| Value | $ 183,845,059 | $ 237,445,474 | $ 297,850,285 |

| Shares Outstanding | 12,534,000 | 12,534,000 | 12,534,000 |

| Per Share | $ 14.67 | $ 18.94 | $ 23.76 |

I have valued this at 8-10x the royalty which we believe is nonetheless conservative. Mesabi Trust (MSB), a US iron ore royalty trust is valued at 8x forward EBITDA. Though I believe SRL’s royalty to be far superior as MSB is quite far from export markets as it is located in Minnesota and is a captive supplier to Cliffs Natural. Altius Minerals published a letter in 2019 targeted at Labrador Iron Ore Royalty (LIORC) arguing that royalties should trade at 12-20x EBITDA and the equity owners at 4-7x. After the letter’s release, LIORC bounced to 12x EBITDA suggesting a market agreement with the low end of the range. Since both SRL’s and LIORC’s royalty agreements are so similar, and their mines are in the same town as each other, it would not be unreasonable for the Scully Royalty to be valued at a similar rate. Below is the mine valued closer to a fair value[7] and using full expected production. We expect full production capacity rates around 2022 from speaking with workers at the mine.

| Bear | Base | Bull | |

| Iron Ore Price | $ 90.00 | $ 100.00 | $ 110.00 |

| Quantity | 6,250,000 | 6,250,000 | 6,250,000 |

| Revenue | $ 562,500,000 | $ 625,000,000 | $ 687,500,000 |

| COGS | $ 133,000,000 | $ 133,000,000 | $ 133,000,000 |

| Net Revenue | $ 429,500,000 | $ 492,000,000 | $ 554,500,000 |

| Royalty | $ 30,065,000 | $ 34,440,000 | $ 38,815,000 |

| less: tax | $ 399,273 | $ 399,273 | $ 399,273 |

| Net Royalty | $ 29,665,727 | $ 34,040,727 | $ 38,415,727 |

| Multiple | 10 | 10 | 10 |

| Value | $ 296,657,270 | $ 340,407,270 | $ 384,157,270 |

| Shares Outstanding | 12,554,000 | 12,554,000 | 12,554,000 |

| Per Share | $ 23.63 | $ 27.12 | $ 30.60 |

It is worth noting that iron ore prices have moved drastically in the past decade. While we should not expect 2011 highs or 2015 lows again, the outlook is nonetheless dependent upon many actors on the supply and demand side. On the supply side, Vale, a major producer or iron ore has had many of their operations shut after a tailings pond collapsed killing over 200. As a resulting inspection found their many of their dams were not as safe as previously rate, they have been forced to scale their operations back. Their operations are expected to take up to two more years to return to a more normal production rate. China, the largest steel producing nation, has pushed manufacturing industries to reduce carbon output. This can be done efficiently by using higher grade iron ore in blast furnaces as it requires significantly less energy to refine, even between 62% and 65.9% grade steel. This helps maintain a wide premium for Iron ore, expected by Tacora to be ~30% over the course of Scully mine. I cannot confidently comment either way if iron ore markets will have the $110+ fines we saw for 65% Fe this summer or closer to $90, but it would not be a crazy assumption to assume the demand for higher grade iron ore will grow because of changing environmental regulations. Last note on Scully mine, between January 1st and March 1st, 2020, they shipped 600k dmt.

Hydrocarbon Portfolio

The hydrocarbon portfolio is a serious black box at Scully. In the past their disclosure was better but the disclosure relating to the current state of the portfolio is quite poor. Management has cited the portfolio as being non-material, though management cites a carrying value for the hydrocarbon related assets at ~$40 million or 37% of the market capitalization. Currently they have 75 natural gas producing wells and 85 non-producing. They have 7 producing oil wells and 14 non-producing ones. They also note a 71% working interest in 86,575 acres of land, though I prescribe no value to this. After many conversations with management, they have little serious intension to drill this land. In the small chance they do develop the land, it would be structured in a royalty model similar to Scully mine, likely using a company named Velvet Energy as the operator. Their natural gas wells can also be easily turned on and the company can and will activate them if prices rise.

Notine Holdings

Notine Holdings is the subsidiary which manages the majority of the hydrocarbon portfolio. Along with Scully’s track record of poor disclosure they never have disclosed Notine to be their subsidiary in filings with my confirmation only coming from directly asking a few management members separately. Currently filings from the Alberta Energy Regulator show 9 active crude oil well batteries in separate locations, implying more wells have been brought online (versus 7 this time last year). They also have a few active compression stations, active gas plant, and a few other undefined “gas gathering systems”[8]. We should expect a growth in their hydrocarbon related revenue over previous years as well as additional impairment reversals as has been the trend for a few years. At the time of writing they have no current offers for any of their hydrocarbon assets. We know the gas plant and the Niton compression station are consistently operating at near capacity, both being profitable. I would expect that the additional facilities activated recently are as well. The compression station generates revenue via processing third party gas. See valuation below with the base and bull estimates estimating a 25%-50% increase in net revenue based upon the increase in facilities, impairment reversals, and discussions with management and employees. Though these valuations are aimed to be on the low side in all situations ascribing zero value to the working land interest and is well below replacement value. Because of the decommission liabilities Scully has related to their hydrocarbon assets, they should be valued below replacement.

| (000’s USD) | Bear | Base | Bull |

| 2018 Net Revenue | $1,440 | ||

| 2019 50% increase | $1,800 | ||

| 2019 100% increase | $2,160 | ||

| Multiple | 10x | 10x | 10x |

| Valuation | $14,400 | $18,000 | $21,600 |

| Per Share (USD) | $1.15 | $1.43 | $1.72 |

Merchant Banking

On December 31, 2019, management took a long-awaited step and began the restructuring of their business. The merchant banking division, named Merkanti Holdings, whose bonds are listed on the Malta Stock exchange, will handle the merchant banking business. We believe this is the first sign of managements intension to spin-off parts of the business as they also organized the Scully Royalty, and Industrial Equity business as completely separate entities. Entities which management informed us would not cross fund each other. Currently, the Merchant banking division is one the highest sources of revenue and the real estate and investment property portfolio are held within it. The Merchant banking division is minimally profitable. Under the Merchant bank there was a Zinc alloy processing facility in Slovakia[9]. Brock Metals sale closed recently in early February 2020. This was a decent source of the Merchant bank’s revenue, but essentially operated at break-even economics. There is a bank in this division, named Merkanti Bank, is primarily focused on trade financing, litigation financing, and merchant banking. With the CFO of Scully as the CEO Merkanti Holdings there is defiantly an effort to grow the bank. Hence why they recently issued a ~$27.5 million secured bond[10]. Though we do not believe this to be an effective use of capital and were pleased to have management confirm they will not use funds from Scully Royalty to fund the bank, or to fund any other existing operations.

Securities and Real Estate Portfolio

Currently Scully Royalty has short-term securities valued at $5.3 million, long-term securities at $3 million, and derivatives at $123,000. The majority of the short-term securities is private secured debt and likely difficult to sell. While some analysts online suggest this may be a portion of a former subsidiary, specifically Lexin resources, we know it is not after speaking with management. Nonetheless, we will value it at 80%, mainly because of the recent market pull back. While I do not believe it to be fully justified, we must account for SRL management potentially selling at depressed prices. They hold $10.3 million is real estate for sale, located in East Germany. Based upon current market conditions, tight German markets and low property appreciation rates, conservatively this can be valued at 90%. They have $29.2 million in investment properties which is a mixture of developed and undeveloped land in Germany. We will assume these are relatively fairly valued since they were recently assessed for a bond issuance[11] and assigned a 10% discount as there are no immediate plans to sell these. They consist of an industrial and commercial park. They receive about $2.5 million in rental revenue per year from the properties and $165,000 in costs related to property management.

| (000’s) USD | Securities | Property Held for Sale | Investment Property | Per Share |

| Discounted Valuation | $6,640 | $8,240 | $26,280 | $3.27 |

Management

Management at Scully Royalty has been less than ideal for quite a while. Despite the CEO, Michael Smith’s early track record of value creative spin-offs and acquisitions, the past seven years have been much less. Part of this is likely because of Scully’s nature in buying distressed assets of which many go sour. He owns a minimal position through trusts. I always prefer that management is heavily aligned with shareholders, unfortunately in this case ownership is too low to incentivize that. Instead I believe that management is acting to keep their own jobs and to earn a higher income.

Currently, three major shareholders control 54.7% of the company.

- Peter Kellogg: the billionaire owns 33% of SRL and has been a shareholder since inception when he purchased 18%. He is heavily underwater now. In 2013 he launched a proxy battle to take control which was resolved by him earning two board seats. He shortly sat on it but has since left. He is 77 years old and wants a fair value realized so he can exit his position.

- Estate of Lloyd Miller III: He was a successful value investor for much of his life and passed away in 2018 owning 14.9%. His estate is overseen by another value investor who has been seeking a fair value of the investments so he can close the estate.

- Nantahala Capital Management: They are a value fund owning 6.8%[12].

After getting into contact with a few, along with speaking with the 4th largest shareholder who has spoken with them all, they all want a fair value realized and have been pressuring management to improve disclosure and not pursuing additional acquisitions. This is the reason I believe management risk is reduced as the largest shareholders want a conclusion. Should management revert on what they have told shareholders, we would expect significant active opposition. We have seen management start to sell off businesses in the past few years, shrinking their hydrocarbon portfolio, selling off businesses in Uganda and Germany. We expect that the December 31st filing, laying out restructuring and promising improved disclosure on all business lines is a step in the right direction. We also look forward to disclosure on the Industrial Equity division as disclosure has been near non-existent on it. We do know a large amount of cash is attributed it attached to this stream and stuck in China, making it difficult to pull-out.

Valuation

| (000s) USD | Bear | Base | Bull |

| Cash | $43,637 | $43,637 | $43,637 |

| Other Assets | $14,530 | $14,530 | $14,530 |

| Securities | $6,640 | $6,640 | $6,640 |

| Real Estate held for sale | $8,240 | $8,240 | $8,240 |

| Investment Property | $26,280 | $26,280 | $26,280 |

| Hydrocarbon Assets | $14,400 | $18,000 | $21,600 |

| Interest in Scully | $183,845 | $237,445 | $297,850 |

| Total Assets | $410,384 | $457,734 | $505,084 |

| Liabilities | $60,306 | $60,306 | $60,306 |

| Net Value (10% Mgmt discount) | $213,539 | $265,019 | $322,624 |

| Shares Outstanding (Not in 000s) | 12,554,000 | 12,554,000 | 12,554,000 |

| Per Share – USD | $17.01 | $21.11 | $25.70 |

| Upside to Price 03/04/20 | 101% | 150% | 204% |

Their trade receivables we valued at 80% and other receivables at 80% to factor in any possible haircuts. Tax receivables at 90% and inventory at 60%. Deposits/ Prepaid is valued at 0%. Assets held for sale at 75%. Liabilities are taken at 100% of payables and include a decommission obligation for the hydrocarbon assets. As well include a $25 million cost for corporate.

Based on the valuations I’ve come to; I believe SRL to be a buy before the April 30th catalyst discussed below. Even if you believe that the management discount should be higher or the mine is worth less, you still get to a $20+ valuation and above a 100% upside at the heavily depressed price at the time of writing: $8.45. Especially as the mine interest is valued a FTM when it will not be at full production. There is the possibility for an additional ~$5 /share once it is closer to capacity.

Risk

Scully Royalty is a company of where the largest risk is disclosure related. A management which can hide information from shareholders is a management which can hurt shareholders. We believe that by spending an immense number of hours and months we have significantly reduced this risk through determining the information which management has not wanted to share. Nonetheless, this is a largely complex business spread across the world and until disclosure improves shareholders must recognize this risk is much higher than normal. We expect that the promised increase in disclosure for the 2019 20-F will reduce this risk and act as a serious catalyst as the market prices in the new information. The other main risks are as follows in no particular order.

Scully Mine is a key risk as it is essential to the business. While it’s profit margins are not of importance to determining royalty checks, any serious commodity swings could cause a much shorter timeline for the mine. The Fe prices are key to the royalty check size, a significant fall in 65% Fe fines would as well reduce the value of the royalty stream. The faces the same systematic risks any mine faces in regard to safety. Also, if the mine faces additional issues in the ramp up our valuation may be too high.

Capital use is one which is commonly cited and rightfully so. Management has no used capital well in the last decade and shareholders have paid. Should management decide to retain cash from the royalty or to use the cash to cross-fund the Merchant banking business, then attaining any fair value is more difficult. They already possess $43.6 million in cash with no long-term debt and minimal liabilities. Growth of this cash stockpile is becoming pointless. Preferably it is paid out or used to repurchase their heavily depressed stock. Though because of stock liquidity issues, management has said they do not want to repurchase stock. I believe this is because they do not want to increase the power of the major shareholders.

Management as mentioned above has acted poorly for a few years shy of a decade. They are the primary reason for the gap in fair value. As such I am used a 10% management discount rate with the discount not being more because of what management has said in recent filing and during calls with myself and other shareholders.

Catalysts

Scully Royalty possess a list of catalyst we expect to occur at similar times. The first is disclosure of Tacora Resource’s operations at Scully mine which will occur in the 20-F to be published on April 30th, 2020. While we are aware of the current state of operations, we know many investors are not, nor have they spoken with employees at the mine as we have. Once disclosed we believe shareholders will price in the impairment reversals which was done last year. While it seemed to be initially factored in, the lack of good disclosure since last year’s 20-F has led to a falloff in valuation.

We also expect that the recent reorganizing is in preparation of a spinoff as that is management’s modus operandi. With shareholders ramping up pressure to realize value, a spinoff is a likely route. Scully was once named Terra Nova Royalty and at that time was purely a check cashing royalty business, it would be within management’s existing playbook to return the business to its former state.

The other catalyst, which we apply a lower value and likelihood to, is a dividend. With the heavy cash load and shareholder’s not wanting management to burn cash again, management may opt for a dividend and we have been informed it is being considered. Though this dividend is unlikely to take place before late 2020. They previously paid a dividend until Scully mine closed in 2014.

Disclosure I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer’s securities.

[1] MFC Bancorp to Scully Royalty, ticker changed at the same time

[2] Based upon the highest price Arbatax trade at in June 1996

[3] Stock appreciation, dividends, share rights, splits included

[4] Source: Tacora Resources

[5] Source: Tacora Feasibility Study

[6] The minimum annual payment is $3.25 million

[7] Though still two turns lower than other similar royalties

[8] https://www.aer.ca/data/codes/ActiveFacility.pdf

[9] Brock Metals

[10] ~$16.5 million of which is going to Merkanti Bank, $11.5m as term deposit and ~$5m as subordinated loan

[11] https://merkantiholding.com/wp-content/uploads/2019/07/MERKANTI-PROSPECTUS_Final-220719.pdf

[12] https://finance.yahoo.com/news/nantahala-capital-management-returns-aum-193815863.html

Present thoughts

I think SRL present enormous risk. Management is proving to act much slower than we should expect. While they claim Covid to have impacted their business, current due diligence suggests otherwise in regard to their core businesses. The mine is operating without issue, never shutting down, infact they had so much extra PPE they were giving it to the government to help out hospitals. As interesting as it may be, if management cannot present a spin-off plan or major dividend by the time they report first half 2020 (December 2020 reporting), I will be moving onward and taking the loses. While I believed the push of the major shareholders wanting fair value and management’s track record of spin-offs would eventually lead to this outcome, it appears it may not be sufficient. At such time I must recognize that my thesis is broken. I’m interested in anyone else’s thoughts on this idea.

Thanks for the write up. Are you still involved?

I’m following the Tacora reorganization and I still think this idea is very interesting.

LikeLike

Not as much any more, shifted to PE

LikeLike